Kenyan Finance Act 2023 Declared Unconstitutional: What Now?

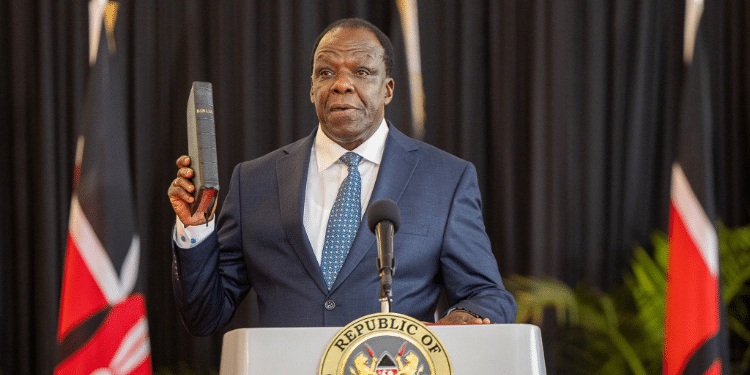

The Kenyan business landscape was recently shaken by the Court of Appeal’s decision to

declare the Finance Act (FA) 2023 unconstitutional. This landmark ruling has significant implications for taxpayers and businesses operating in Kenya.

The FA, 2023, was assented to law on 26 June 2023 eliciting 11 consolidated constitutional petitions filed at the High Court’s Constitutional and Human Rights Division in Nairobi.

The 11 Petitions sought to have the FA, 2023 declared unconstitutional arguing broadly among other grounds, that for FA, 2023 to be passed it required the concurrence of the Senate and involvement of the public regarding the amendments passed on the floor of ‘the House’.

Further, the Petitioners at the HC argued that the proper legislative process including public

participation was not followed while enacting the FA, 2023. At the center of the petitions was

the issue of whether the Affordable Housing Levy (AHL) was constitutionally introduced

through the FA, 2023.

The government has appealed the decision rendered by the Court of Appeal at the Supreme Court. However, the Supreme Court has declined the government’s prayers for the judgement of the lower court to be set aside pending the determination of the appeal. This essentially means, that the Court of Appeal Decision on FA, 2023 currently still stands until the appeal is heard and determined by the Supreme Court.

Understanding the Court’s Decision

The Court of Appeal found that the process leading to the enactment of the Finance Act

2023 was fundamentally flawed, violating the Constitution in several ways:

Lack of Public Participation: Crucial amendments were introduced without proper public

consultation, undermining the principles of transparency and accountability.

Bypassing the Senate: The Act included non-money bill provisions that required Senate

involvement, which was bypassed.

Disregarding Budgetary Procedures: The Act’s introduction and passage did not adhere to

the established budget-making process outlined in the Constitution and the Public Finance

Management Act.

Immediate Impacts for Taxpayers

According to a tax advisory published by professional services consulting firm, PwC Kenya,

the court’s decision triggers a return to the pre-Finance Act 2023 tax regime (Finance Act

2022).

“In the intervening period, in absence of a stay of execution, the Judgment of the CoA has the full force of law and accordingly, the the government has to revert to the pre-FA 2023 for revenue collection,” says the advisory published by PwC Kenya Tax experts, led by Job Kabochi, Partner in charge of Indirect Taxes.

Here’s what this means for you:

VAT Reversals: The VAT on petroleum products and LPG reverts to 8% from 16%. Exported taxable services are now subject to 16% VAT, except for Business Process Outsourcing (BPO) services.

PAYE Adjustments: PAYE tax bands revert to the 2022/2023 fiscal year rates, with the

highest rate being 30%.

Withholding Tax Timelines: Payment deadlines for withholding tax and VAT revert to the

20th day of the following month.

E-TIMS Regulations: Challenges faced in complying with the e-TIMS regulations introduced by the Finance Act 2023 are now moot.

Excise Duty Changes: The repeal of the annual inflation adjustment for excise duty is reversed.

Affordable Housing Levy (AHL): It’s important to note that the AHL remains applicable and

payable under the separate Affordable Housing Levy Act, 2024.

While the Court of Appeal’s decision brings clarity to the current tax landscape, the journey

is far from over. The government has appealed the ruling to the Supreme Court, and the

outcome of this appeal will ultimately determine the fate of the Finance Act 2023.