Faulu Bank Keen on Empowering Small Businesses and Agricultural Enterprises in Kenya

Faulu Microfinance Bank has restated its commitment to empowering small businesses through personalised financial solutions. The commitment reinforces the organization’s bid to empower small businesses by providing them with accessible and flexible financing products and business support.

The bank is keen on extending its focus to promote small businesses in both urban and rural areas through a comprehensive range of financial products for managing and expanding their business operations. From flexible transactional accounts, investment solutions, accessible microloans to insurance solutions, the bank will ensure that small businesses owners have the financial support to thrive in today’s competitive market.

Faulu Bank’s Micro Secured Loan, for example, now gives small entrepreneurs a flexible option to access large amounts of credit. This loan facility is intended to give businesses a financial boost through access to working capital, Local Purchase Order (LPO) financing and funding for business emergencies.

“We believe that when small businesses succeed, communities thrive. That is why we are constantly innovating our services to meet the diverse needs of our clients. We shall endeavour to providing accessible financing and personalized support to enable small businesses across the country to navigate challenges and improve their daily operations,” said Faulu Bank’s CEO, Julius Ouma.

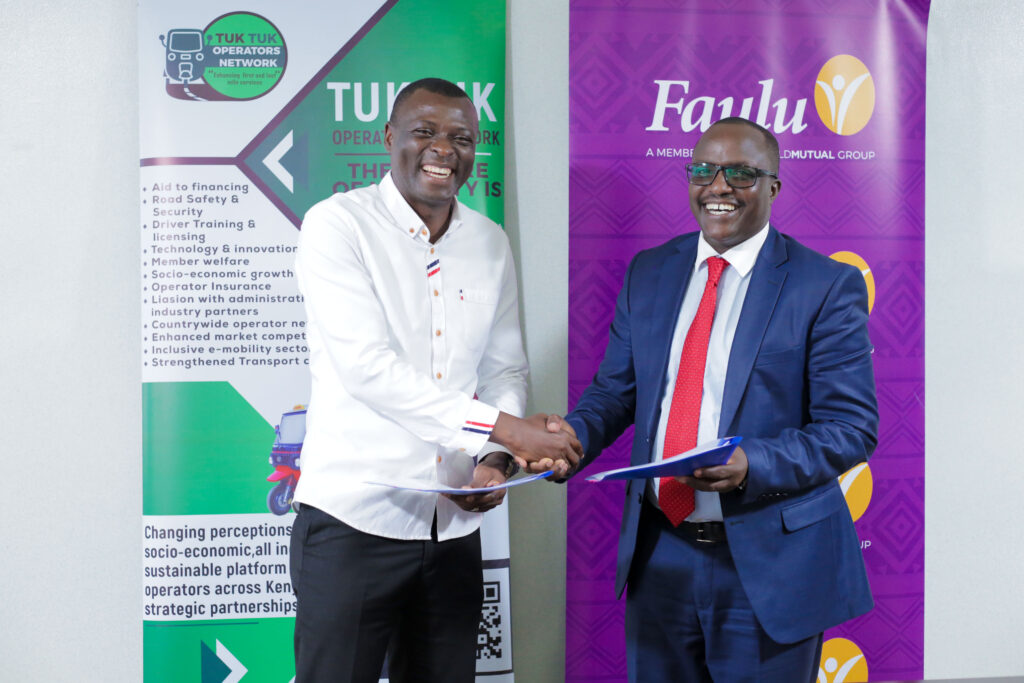

As a leading traders’ bank, Faulu Microfinance Bank also has ongoing partnerships with local business entities to further underscore its commitment to empowering small businesses.

The bank recently partnered with the Tuk Tuk Operators Network to offer accessible financing options for entrepreneurship in the three-wheeler transport sector. This partnership is part of the bank’s initiative to promote sustainability and independence in small businesses while aligning with the country’s broad goal of economic development.

Additionally, the bank continues to support small farmers through tailored agribusiness financing products. Under this facility, for example, tea farmers can secure agribusiness credit within 48 hours for loans of up to 75% of the value of tea bonuses earned in the most recent three years.

Moreover, the bank is committed to providing insurance products tailored to the needs of small businesses. These products protect businesses against potential losses, such as property damage, theft and business interruption. For example, the Faulu Farm Machinery and Equipment Insurance indemnifies the actual loss of gross profit sustained from a business interruption caused by an accident covered under machinery insurance. The product covers farm machines and equipment against fire and perils, breakdown, burglary, consequential loss among other risks.

“Agribusiness plays a critical role in the growth of our economy and food security, yet it often faces significant challenges. Faulu Bank is dedicated to supporting small scale farmers and agricultural traders with access to financial solutions that support growth and sustainability in their daily business operations. Further, our insurance products will ensure that our customers have confidence and peace of mind, knowing that their businesses are protected from unforeseen risks,” said Ouma.